RAM Shortage AI Price Impact 2026 is no longer a theoretical headline—it is becoming the central story in the smartphone and PC market.

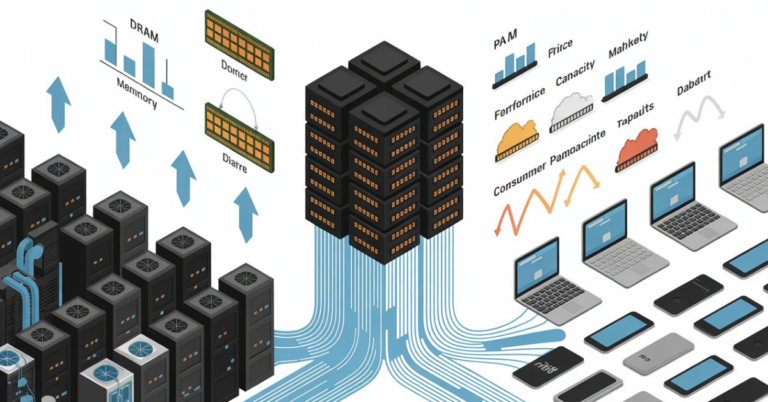

As AI data centers absorb more DRAM, consumer devices are left fighting over a tighter pool of memory supply.

Analysts now warn that this structural shift could raise memory prices by up to 40% and push average smartphone prices higher in 2026.

The real question is not whether prices rise, but how hard the squeeze will hit different segments of the market.

How AI is hijacking the RAM market

The core of the RAM Shortage AI Price Impact 2026 story is simple: AI servers have become the preferred customer for memory manufacturers.

Hyperscale data centers running large language models buy vast quantities of high-margin DRAM, diverting supply away from phones and PCs.

IDC now forecasts that DRAM supply growth in 2026 will slow to about 16% year-on-year, well below historical averages.

“AI has structurally reprioritized where every incremental gigabyte of DRAM goes,” explains Dr. Lina Moretti, semiconductor economist at Politecnico di Milano; “consumer devices are no longer the top of the food chain.”

This reallocation matters because DRAM is not easily or quickly expanded; new fabs take years, not quarters.

Until that capacity arrives, AI infrastructure soaks up a disproportionate share of output, leaving device makers to absorb both higher prices and tighter volumes.

What analysts say about 2026 pricing

Several major research houses have converged on the same direction of travel for the RAM Shortage AI Price Impact 2026.

Counterpoint Research estimates that memory prices could rise another 40% through the second quarter of 2026, pushing smartphone bills of materials up by 8–15%.

In parallel, IDC’s device outlook flags DRAM and NAND as the main bottlenecks, with constrained supply already lifting component prices.

As a result, Counterpoint expects global smartphone shipments to fall around 2.1% in 2026, even as average selling prices climb by roughly 6.9%.

“In the case of the upcoming memory crisis, this is something that will hit the market hard,” IDC senior research director Nabila Popal told CNET, noting that vendors will have almost no choice but to pass higher memory costs to consumers.

Building on that, Lead analyst Marcus Dellon at Horizon Insight notes that “each 10% rise in DRAM pricing tends to show up as a visible step-up in flagship phone pricing within a single product cycle.”

Who gets hit hardest: premium vs budget

Memory is not a flat cost across the market, which shapes the RAM Shortage AI Price Impact 2026 narrative.

On budget phones, RAM can account for 20% or more of the total bill of materials, leaving manufacturers little room to absorb shocks without raising prices or cutting specs.

Counterpoint’s December update indicates that low-end models are already seeing BoM increases of 20–30%, versus 10–15% for mid- and high-end devices.

“In the lower price bands, steep price increases on smartphones are not sustainable,” Counterpoint senior analyst Yang Wang warns, predicting portfolio cuts and fewer ultra-cheap SKUs.

By contrast, giants like Apple and Samsung have scale advantages, diversified lineups, and stronger margins, allowing them to smooth some of the impact.

“Tier-one OEMs can trade off margin, storage tiers, and marketing budgets in ways smaller brands simply cannot,” argues Sarah Kwon, mobile strategy lead at FutureWave Consulting.

PC market: collateral damage from AI servers

The PC industry is not immune to the RAM Shortage AI Price Impact 2026.

IDC warns that, under pessimistic scenarios, PC shipments could shrink by up to 9% in 2026 as DRAM and SSD prices climb and Windows 10 refresh demand collides with constrained memory supply.

That dynamic is amplified by the push toward “AI PCs,” which require more memory per device and further intensify competition for DRAM.

“AI-centric PCs arrive at exactly the wrong moment for the memory market,” says Dr. Julio Ramirez, AI systems researcher at ETH Zurich; “they boost per-unit DRAM needs just as supply is structurally re-routed to data centers.”

How consumers and brands can respond

For consumers, the RAM Shortage AI Price Impact 2026 means planning device purchases more strategically.

Shoppers may see higher launch prices, fewer aggressive discounts, and more models that subtly reduce RAM or storage at a given price point.

Brands, meanwhile, are experimenting with mitigation: tighter SKU portfolios, negotiated long-term memory contracts, and more RAM-efficient software.

Longer term, node transitions and next-gen standards such as LPDDR6 could ease pressure by increasing density and cutting power, but those benefits will arrive gradually rather than overnight.

Key Takeaways

-

RAM Shortage AI Price Impact 2026 is driven by AI data centers absorbing a growing share of global DRAM output.

-

Memory prices could surge up to 40% by mid‑2026, pushing smartphone BoM costs 8–15% higher.

-

Average smartphone prices are expected to rise about 6.9% while shipments decline around 2.1%.

-

Low-end devices face the harshest pressure because RAM forms a bigger slice of their total component cost.

-

PC markets will also feel the squeeze as AI PCs and Windows refresh cycles collide with tight DRAM supply.

Related Article:

Why Small European Businesses AI Adoption Explodes Now